Did you make any mistakes on your tax return? Did you forget to claim something that is deductible? There\’s nothing to worry about because you can send a new form that will help you claim the refund without getting in any trouble whatsoever.

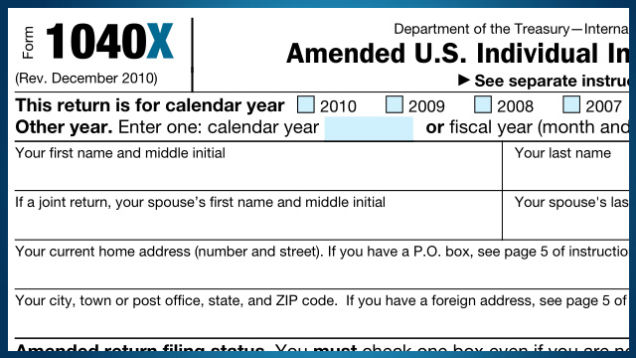

Luckily the IRS is familiar with taxpayers sending incorrect paperwork so all you need to do is amend your original return to fix this situation. The form we\’re talking about is IRS Form 1040 X and if you made a mistake when filing your personal tax information on the original request this article is going to help you fix things. Let\’s find out how your mistakes can be corrected when filling out the new request.

Why

In some cases amending your initial tax return is required and it usually relates to modifications on your filing status related to your personal income or tax deductions with credits missing on the original return. There are also other reasons to correct the original information sent to the IRS so you can repeat the same procedure if you forgot to include all the information necessary, made a mistake or you were unaware of a certain situation that was taxable at the time of the initial request.

First column

Form 1040 X contains 3 columns so we\’re going to explain each one in order for you to understand what needs to be done. On the first column (Column A) you need to provide all amounts claimed on your original tax return paperwork.

This means you need to rewrite all the numbers you put down on your original tax form regardless if you made a mistake calculating your information or not. This is standard procedure so that the IRS will assimilate your initial form and figure out where exactly the mistake was made.

Second Column

The second column (Column B) is for additional changes to your income. If it turns out that you owe additional tax and you paid via EFTPS check, money order, debit or credit card and you want to request a tax return for that financial operation, this is the column you need to pay attention to.

Don\’t attach your payment with the Form 1040 X but be sure to include it in the envelope with your amended return. You can visit the Payment section on the IRS website to pay electronically.

Third Column

The third column (Column C) is dedicated to your new information and in addition to this you need to explain on the second form every modification made while going as precise as you can for the IRS staff to understand the information that was ultimately changed and the exact reason why this was necessary.

After finishing all three columns be sure to include a copy of your new tax return. You also need to attach copies of all the previous files sent – the ones affected by any modification – and the W2 file if you received it after originally sending your documents to the IRS.

Be sure to arrange the new copies according to \”Attachment Sequence No.\” found on top of every file provided. This will get the files to be processed easier and it will also allow the IRS staff to notice that your amended return is complete.

How

Form 1040 X should only be submitted after the original return was filed and it needs to have every additional modification that was made. Usually it takes up to 12 weeks for the IRS to process your 1040 X form but you can check the status by calling 1-866-464-2050 or by visiting www.irs.gov, clicking on Tools and then \”Where\’s my amended return\”. The processing time actually depends on how quick you managed to avoid the tax season.

If you think you\’re entitled to have a return you must file the amended documents within 3 years after the original request or 2 years after you paid your taxes – whichever is later in your case. This type of situation requires extra attention because if you weren\’t careful enough to check the status of your payment according to the original deadline you will also owe interest and penalties.

In addition to all the files mentioned above you it\’s usually necessary to send an amended State return in order to report the Federal changes. Your State return should be delivered as quickly as possible so that you\’ll be able to minimize any potential damages when it comes to penalties and interest to the IRS.